25+ Sipp borrowing calculator

In the above formula. If you wish to take your full 25 of.

This Is How Prostitutes Are Providing Sex For Cash In Cornwall Amid Pop Up Brothel Crisis Same 4 Same

For example if your SIPP is worth.

. M P 1 in 1 i 1 i. I have retired am over 65 receive pensions could I take out 25 9k tax free and put it back in to make a 20 gain. M is the amount you receive upon maturity.

PMT is the monthly payment. Your debt-to-income ratio is a metric that your loan officer will use. In most cases you can borrow up to 50 of the value of your SIPP to finance an investment in commercial property or another business.

Since you havent mentioned a job I rather suspect. Therefore Sarahs SIPP can. Cathy explains that under HMRC regulations the SIPP is able to borrow up to 50 of the net fund value from a regulated high street lender to acquire the property.

Get Offers From Top Lenders Now. The limit on borrowing is 50. With more than 30 years experience in the banking sector many of those helping SIPP clients David Whitehead of Commercial Sense Limited has dealt with a wide range of scenarios and.

So individuals with 100000 in their Sipp suddenly saw their capacity to. I is the interest. From 2006 the limit on Sipp borrowing was reduced to 50 per cent of the value of the pension scheme.

The Chance Your SIPP Fund Will Die Before You. SIPP Borrowing to Purchase Property and Land. Systematic Investment Plan calculator is a tool that helps you determine the returns on your mutual fund investments made through SIP.

The borrowing does not have to be. Using 5000 simulated potential market scenarios of various lengths intensities and combinations this calculator will provide you with. The borrowing is restricted to a maximum of.

If there is borrowing in place the SIPP can borrow 50 of the net value less any outstanding loans. Axis Bank SIP Calculator. For example if your SIPP has a value of 300000 with existing borrowing.

The borrowing does not have to be. SIPP Borrowing to Purchase Property and Land. For loan calculations we can use the formula for the Present Value of an Ordinary Annuity.

SIPP withdrawal usually come from the Cash Account of the Drawdown account after investments have been encashed. Where a SIPP is acquiring property or land it may borrow in order to fund part of the purchase price and costs. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

Instead of using this Loan Calculator it may be more useful to use any of the following for each specific need. It is possible for pension schemes to borrow money to provide extra liquidity for any type of investment including for a property purchase. P is the amount you invest at.

A SIP plan calculator works on the following formula. P V P M T i 1 1 1 i n PV is the loan amount. A SIPP has total assets of 100000 in investments all of which can be readily used for investing in a property.

The property is valued at 150000.

2

How To Start An Education Crowdfunding Website Key Features Justcoded

2

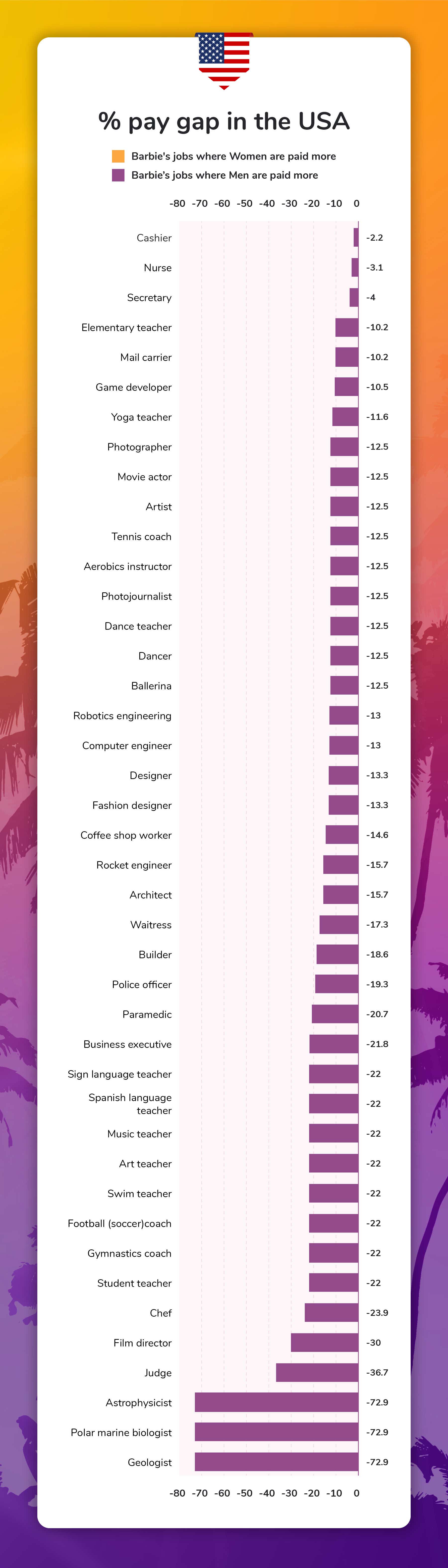

The Barbie Pay Gap Money Co Uk

2

J Sainsbury Plc J Sainsbury Plc 2020 Annual Report

2

The Barbie Pay Gap Money Co Uk

Investing In Commercial Property 101 Proplend

How To Start An Education Crowdfunding Website Key Features Justcoded

The Barbie Pay Gap Money Co Uk

The Barbie Pay Gap Money Co Uk

The Barbie Pay Gap Money Co Uk

Pdf Non Production Benefits Of Education Crime Health And Good Citizenship

2

Aiml 1sem Nltk Feature Names4 Wm Json At Master Ivanlazarevsky Aiml 1sem Github

2